Overhaul of international corporate taxation: A Finnish perspective

25.6.2020 Blog Seppo Kari, Ilpo Kauppinen, Olli Ropponen

International corporate taxation is in need of an overhaul but none of the reform proposals made so far provides an entirely satisfactory solution to the problem. The Common Consolidated Corporate Tax Base (CCCTB) proposed by the European Union would change the fundamentals of the international tax system and limit profit shifting. At the same time, it would probably also reduce Finland’s corporate tax revenue. A combination of different corporate tax reforms is unlikely to result in a workable package.

International corporate taxation is in need of an overhaul

In a globalised and digitalised world, international corporate taxation is in need of an overhaul. The current system is particularly ill-suited for the taxation of multinational companies because it treats each member company of a multinational group making global decisions as a separate taxable entity. It also aims to ensure that the right to tax is exercised where value is generated even though determining the location of value generation is becoming increasingly difficult.

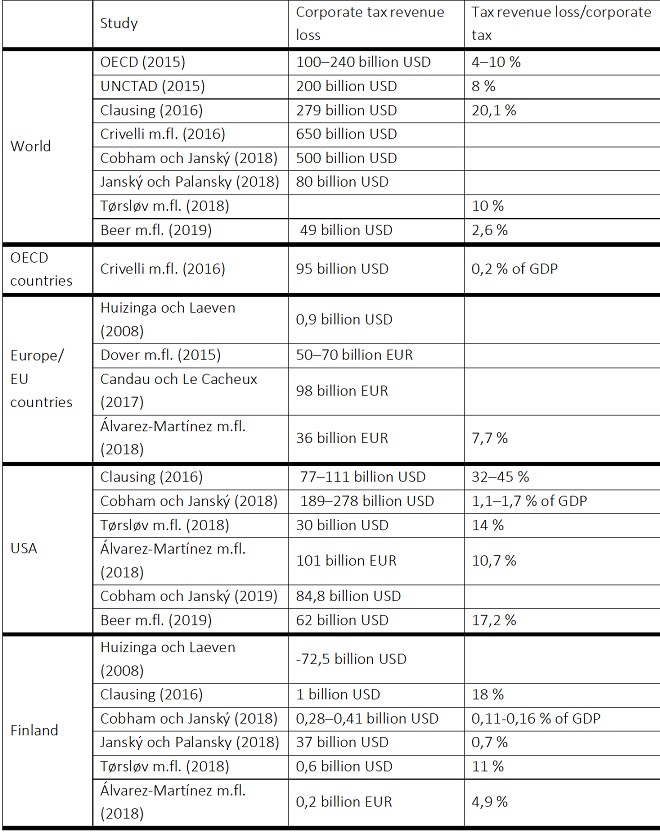

The current system encourages multinational companies to shift profits to low-tax countries, which in turn encourages countries to engage in tax competition eroding global corporate tax revenues. According to some estimates, profit shifting is causing corporate tax revenue losses totalling hundreds of billions of euros in global scale.1 For Finland, the losses probably amount to hundreds of millions of euros each year. Profit shifting also distorts the division of tax bases between countries and the competition between multinational groups and enterprises operating at national level.

Would a common tax system solve the problem?

Both individual countries and multinational parties have been seeking ways to prevent tax avoidance. The 15-point action plan set out in the Base Erosion and Profit Shifting (BEPS) project of the OECD lists recommendations that would make national tax systems more resistant to tax avoidance.2 At the same time, the Anti Tax Avoidance Directive (ATAD) of the EU contains changes in the tax system that each of the Member States must incorporate in its national legislation.3 Finland, too, has applied the rule limiting debt interest deductions (set out in both schemes) since the start of 2014.4 The existing structure of the international corporate tax system, especially the separate taxation of companies, would remain unchanged under all proposals.

Unlike ATAD and BEPS, the Common Consolidated Corporate Tax Base (CCCTB)5 set out in a directive proposed by the European Commission in 2016 would change the fundamentals of the tax system and it would also allow the taxation of profits reported outside the country’s borders. CCCTB would combine the profits of the member companies domiciled in the EU into a common group-level tax base. The right to tax the consolidated tax base would be shared between EU Member States using an apportionment formula in which consideration is given to the location of the group’s production factors and the markets for its products.

The OECD has also proposed a reform that would change the fundamentals of the tax system.6,7 Under the proposal, the profits of international companies would be divided into two parts. The part corresponding to ‘normal profits’ would be taxed in accordance with the existing rules but the portion exceeding it would be allocated between the countries in which the companies’ customers live, using a fixed formula. There would also be instruments to ensure that companies pay a certain minimum level of taxes on their profits.

CCCTB would reduce corporate tax revenue

The main aim of the CCCTB proposal put forward by the European Commission is to create a system allowing more effective prevention of tax avoidance. It is a continuation of a proposal presented in 2011, to which a number of new elements (such as two-stage implementation) have now been added. In the first stage of the reform, the tax base legislation of the individual countries would be harmonised. In the second stage, the tax bases of the group companies would be combined and allocated between countries using an apportionment formula in which the location of sales, employees and capital in the Member States is considered. Joining the system would be mandatory for large corporations. As part of CCCTB, the European Commission is also proposing an AGI deduction on equity, a generous R&D deduction and new anti tax avoidance measures, such as limitation on interest deductions, CFC legislation, and general anti tax avoidance legislation. Tax rates would remain at the discretion of the Member States.

Determining the tax base at group level would mean automatic and full alignment of profits and losses across individual group units, which, as a rule, would shrink the tax base. At the same time, reallocation from low-tax countries to high-tax countries would increase global tax revenue.8,9

We have assessed the impacts of the reform on Finland’s corporate tax revenue.10 The calculations produced for the assessment are static, which means that the changes in the behaviour of companies and countries resulting from the reform have not been considered. According to the calculations, the Finnish tax revenue would probably shrink under the new system. The automatic intra-group alignment of profits and losses, and the AGI and R&D deductions are the main reasons for the decrease. While reducing tax revenue, the deductions also make the new system attractive to companies that are of such size that they could stay outside it. They also encourage investments and capital accumulation. It is estimated that the reform package would reduce the Finnish tax revenue by 16% whereas the tax revenue would increase as much as 10% without the AGI and R&D deductions. In fact, contrary to what is stated in some previous estimates, it seems that the formula used for apportioning the tax bases among countries would not in itself be particularly problematic for Finland and the reasons for lower tax revenues have to be sought elsewhere in the system.11

The large number of corporate tax reform proposals have produced little clarity

In the light of our static tax revenue calculations, the CCCTB proposal presented by the European Commission in 2016 is not particularly attractive to Finland. The system would also encourage corporations to strategically select locations offering the financial variables contained in the apportionment formula. This might have problematic effects on the regional distribution of production and tax revenue in Europe. The tax incentives and the automatic intra-group loss offset proposed by the Commission would, however, encourage companies to make investments and expand their operations.

The system might well increase tax competition between countries. Under the new system, countries would no longer compete with ‘profits on paper’ but the focus would be on companies’ real-economy operations. Targeted tax relief would no longer be possible under the new system as the same tax base rules would apply to all companies. This could further underline the role of the corporate tax rate in the tax competition. Moreover, the system would be limited to the Member States of the European Union. The current system (and its shortcomings) would continue to apply to transactions between group companies operating in Europe and in other parts of the world.

It also seems that none of the other proposed reforms would offer an entirely satisfactory solution to the problems of international corporate taxation. The BEPS project of the OECD and the ATAD directive of the EU will probably succeed in reducing profit shifting but they will also make the tax system more complex by burdening the public administration and companies with additional costs.12 Preliminary assessments also suggest that there are problems with the (not yet finalised) proposals of the OECD.13 Serious difficulties may arise from a package resulting from a large number of overlapping reforms, which is unlikely to meet the general requirements for a good tax system.14 In fact, the best option would be to launch an expert-driven process to create a long-term strategy for international corporate taxation.

.

Table 1. Tax revenue losses caused by profit shifting - estimates presented in the literature. Source: Lumme and Ropponen (2020).

_____

References

1) Lumme, Mikko and Olli Ropponen (2020) Monikansallisten yritysten voitonsiirto ja yhteisöveropohjan rapautuminen – kokoluokan arviointia kirjallisuuden valossa, VATT Muistio 58

2) OECD (2013) Addressing Base Erosion and Profit Shifting, 2013, OECD Publishing

3) European Commission (EC 2016a) Proposal for a council directive laying down rules against tax avoidance practices that directly affect the functioning of the internal market, COM(2016) 26 final, 2016/0011(CNS), Brussels, 28.1.2016

4) Harju, Jarkko, Ilpo Kauppinen and Olli Ropponen (2017) Firm Responses to an Interest Barrier: Empirical Evidence, VATT Working Papers 90

5) European Commission (EC 2016b) Proposal for a council directive on a Common Consolidated Corporate Tax Base (CCCTB), COM(2016) 683 final, Strasbourg 25.10.2016

6) OECD (2019a): Secretariat proposal for a‘unified approach’under Pillar 1, Paris: OECD Publishing

7) OECD (2019b): Global Anti-Base Erosion Proposal (‘GloBE’) - Pillar Two, Paris: OECD Publishing

8) Cobham, Alex and Simon Loretz (2014) International Distribution of the Corporate Tax Base: Implications of Different Apportionment Factors under Unitary Taxation, ICTD Working Paper 27

9) De Mooij, Ruud, Li Liu and Dinar Prihardini (2019) An Assessment of Global Formula Apportionment, IMF Working Paper WP/19/213

10) Kauppinen, Ilpo and Olli Ropponen (2020): Yritysveropohjan harmonisointi (CCCTB) ja Suomen yhteisöverotuotto, VATT Tutkimukset 190

11) Wessman, Roger (2019) EU-komissio haikailee yhteisöveron mullistusta – se siirtäisi verotuloja paitsi veroparatiiseista myös Suomesta heikommin pärjääviin EU-maihin, MustRead, 7.8.2019

12) Collier, Richard, Seppo Kari, Olli Ropponen, Martin Simmler and Maximilian Todtenhaupt (2018) Dissecting the EU’s Recent Anti-Tax Avoidance Measures: Merits and Problems, EconPol Policy Report 08-2018

13) Ks. esim. Devereux, Michael, Francois Bares, Sarah Clifford, Judith Freeman, Irem Guceri, Martin McCarthy, Martin Simmler and John Vella (2020) The OECD Global Anti-Base Erosion Proposal, Oxford University Center for Business Taxation, Said Business School

14) Kari, Seppo, Timo Rauhanen, Essi Eerola, Tuomas Kosonen, Teemu Lyytikäinen and Tuukka Saarimaa (2013) Hyvän veropolitiikan periaatteet, VATT Tutkimukset 47. For applying these principles to international taxation reform, see Devereux, Michael: Principles of International Taxation.

Ilpo Kauppinen

Olli Ropponen

Seppo Kari

Blog

Blogit

Blogit

Business regulation and international economics

Column

Industrial and economic policy

Taxation

Valtori

corporate income tax

tax policy

tax reforms

taxation