New study: Risk-based tax audits increase tax revenue by changing firm behaviour

Following a tax audit, firms immediately report more taxable profit, and the reported profits also remain higher for at least five years after the audit. These changes in firms’ reporting behaviour explain one third of the tax revenue generated by tax audits.

The Finnish Tax Administration conducts tax audits as part of its tax monitoring activities. A study by the VATT Institute for Economic Research, Tampere University, and the Finnish Centre of Excellence in Tax Systems Research (FIT) examined how tax audits impact tax revenue and the firms’ behaviour. The study finds that tax audits increase reported profits, and thus the taxes paid, both immediately and in the longer term. The risk of bankruptcy following a tax audit also increased, but only for firms with a tax deficit.

The average amount of unpaid taxes found in a tax audit is €21,000. Following an audit, firms change their reporting behaviour and report on average €9,000 more in taxable profit, value added taxes (VAT), and payroll taxes over the next five years. Firms with unpaid taxes made the largest increases to their reporting after the audit.

"In the study, we follow firms' activities after the audit and observe changes in their reporting behaviour. Tax audits are likely to change firms' perceptions of the likelihood of being caught evading tax, and they start reporting their income and expenditure more truthfully. The study shows that tax revenues generated through these behavioural effects account for one third of the tax revenue generated by tax audits", says Senior Researcher Annika Nivala from VATT.

Following an audit, firms’ reported profits increase and remain higher

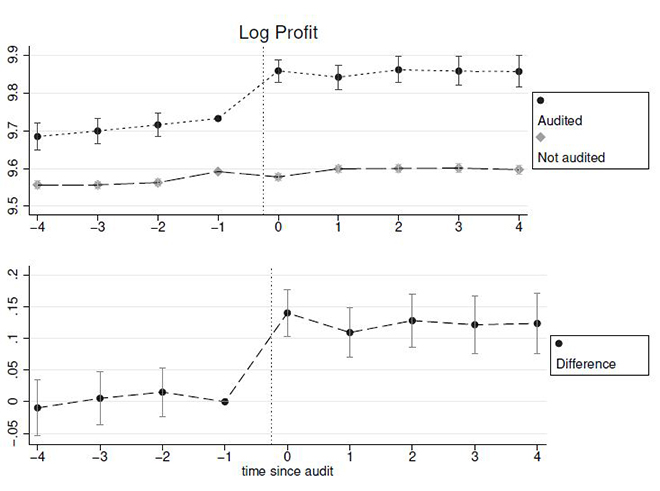

The study compares companies that were audited with similar companies that were not audited. The reported profits of audited firms increased on average by 12% immediately after the audit, which equates to around €2000 more taxable income per firm per year.

In addition, the amount of VAT reported by the audited firms increased on average by 6% after the audit, which is equivalent to around €5,200 per firm per year. The reported profits and VAT also both stay on a higher level for the entire five-year follow-up period.

"The immediate sharp change in the way profits are reported directly after the tax audit indicates that some companies are evading taxes by under-reporting profits. The persistence of the change indicates that tax audits also have a longer-term impact on firm behaviour", says Nivala.

Businesses reduce tax payments by not declaring all labour costs

Underreporting revenue is one of the ways firms can try to avoid taxes. The study finds that after a tax audit, firms’ revenue increases by 4.5%. Firms also try to reduce tax payments by under-reporting their expenses, in particular labour costs. On average, following a tax audit, company staff increases by 3%, labour costs by 6% and wage costs by almost 7%. Other costs increase by less than 2%.

"By not declaring labour costs, companies can avoid compulsory employer contributions, which account for around a quarter of wage costs in Finland. Without credible tax audits, firms' declarations of their employees' incomes might not be as reliable, which would in turn make it more difficult to monitor the compliance of their employees’ personal taxation", says Nivala.

Tax audits increase the likelihood of bankruptcy for non-compliant firms

The study finds that the probability of bankruptcy increases by 39% for audited firms after a tax audit. This change is explained by the bankruptcy of companies found to have unpaid taxes in the audit. The risk of bankruptcy for audited firms with no tax deficit remained at 4%, the same level as for the control group.

"The results suggest that tax audits may remove dishonest operators from the market. Tax evasion reduces government tax revenues and affects competition between businesses, because the costs of operating legally are higher. Tax audits can therefore have a beneficial effect on the functioning of the market," says Professor Kaisa Kotakorpi, Director of the Finnish Centre of Excellence in Tax Systems Research at Tampere University.

Reliable research design

The study analysed around 40 000 firms that were audited between 2003 and 2016. The data used combined the Tax Administration data from all tax audits of Finnish firms with the firms' tax returns. The reporting behaviour of the firms was examined four years before and four years after the tax audit. The tax returns of audited firms were compared with those of similar firms that were not audited. The methodology limits the comparison to mainly small and medium sized enterprises, as the number of both audited and non-audited firms is large enough within this size-group.

Figure 1. The slope of the (logarithmic variable) graph shows how the profits reported by firms change in the years before and after the tax audit. The graph shows that audited and non-audited firms evolve in the same way before the audit, although the audited firms on average have higher profits before the audit. The graph shows a clear increase in the profits of audited firms relative to non-audited firms for the audit year and the following four years. According to the study, firms report over 10% more profits immediately after an audit and the profits stay on a higher level for the next five years.

Study:

Jarkko Harju, Kaisa Kotakorpi, Tuomas Matikka and Annika Nivala (2024) How Do Firms Respond to Risk-based Tax Audits? VATT Working paper 165/2024.

More information:

Annika Nivala

Senior Researcher, VATT Institute for Economic Research / Centre of Excellence in Tax Systems Research (FIT)

[email protected]

Tel. 0295 519 405

Kaisa Kotakorpi

Professor, Tampere University

Director of the Center of Excellence (FIT)

[email protected]

Tel. 0503182487

Finnish Centre of Excellence in Tax Systems Research (FIT) provides high-quality scientific research on public policy to support the design and development of tax and transfer systems. FIT is a joint initiative between Tampere University, the VATT Institute for Economic Research and the University of Helsinki, and it has been selected by the Academy of Finland as a Centre of Excellence (2022-2029). Find out more about our work.

Annika Nivala

Tuomas Matikka

Business taxation and regulation

Centre of Excellence in Tax Systems Research

Press release

Social security, taxation and inequality

Taxation

Uutiset ja tiedotteet