Finland’s fuel tax does not particularly fall upon low-income households

20.5.2021 Blog Anna Sahari (VATT) ja Kimmo Palanne (VATT)

Emissions reduction targets in road transport are unlikely to be achieved without increasing the cost of driving for petrol and diesel-powered passenger cars. Fuel taxes are an effective means to reduce emissions and they do not particularly fall upon low-income households. Recycling tax revenue back to households is one method of balancing the tax burden between households and can also lead to fuel taxes being considered more acceptable.

In Finland, passenger cars account for roughly one half of road traffic emissions, and roughly 10% of all greenhouse gas emissions. Given the target to halve transport emissions by 2030, it is inevitable that passenger vehicles will also face emission reduction measures.

Emissions from passenger cars can be cut either by reducing kilometres driven or by cutting emissions per kilometre. Studies show that motorists’ choices can be influenced through taxation (Palanne, Sahari 1). If the purchase, ownership and use of a car are taxed according to the car’s emissions, people will buy cars that pollute less, and drive less. A fuel tax reduces emissions more cost-effectively than any other tax. For example, an increase in the car tax will result in lower emission reductions than a comparable increase in the fuel tax.

However, a concern related to fuel taxes is that they are borne disproportionately by low-income households. An increase in fuel taxes would mostly fall on those households who spend the largest share of their income on fuel. This is conditional on households not reducing their fuel consumption significantly when prices change. Fuel taxation would fall relatively more on the lowest income categories, if fuel expenses and the share of the fuel tax therein are higher for lower-income households compared to higher-income households.

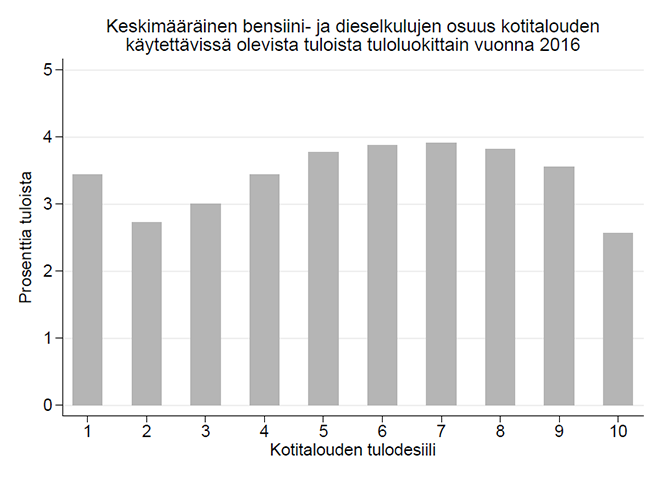

Statistics do not support the conclusion that fuel taxation in Finland particularly falls on the lowest income categories. A recently published VATT memorandum examines the distribution of emissions from passenger cars by income level and residential location. The memorandum also describes the distribution of fuel expenses by income category. The following chart shows average petrol and diesel expenses as a share of household disposable income by income category in 2016 (figure 1).

Figure 1. Average petrol and diesel expenses as a share of household disposable income by income category in 2016. Figure includes percent of income and household income decile. Income category 1 consists of households whose disposable income fall within the lowest 10th percentile of the entire population's income, and income category 10 consists of households with disposable income in the highest 10th percentile. Household fuel expenditure has been calculated using average fuel prices, mileage based on annual vehicle inspection data and fuel consumption reported in vehicle stock data (Palanne, Sahari 2).

On average, low-income households do not incur more fuel costs in relation to their income compared to average-income households. In Finland, the share of fuel expenses increases with income between the low second and high seventh income category. In the highest income categories, the share decreases.

The averages in categories 1 and 10 do not represent typical households in these categories. For instance, more than half of the households in the 1st category do not have a car. These income categories have exceptionally large differences across households within each category.

A possibly uneven incidence of taxation across income categories can be mitigated, for instance, through partial or full tax refunds to the households. It is important that this tax refund is independent of the household's fuel expenses. This way, taxation incentivises people to reduce their fuel consumption. As an example, every adult resident in British Columbia, Canada is given a state tax refund four times per year. The refund is paid from the state’s carbon dioxide tax revenue, and the tax return is higher for households with lower incomes.

References:

1) Palanne, Sahari: CO2 emissions from passenger cars and control of emissions through taxation, VATT Mimeo 63. The publication includes a literature review of the empirical research related to car taxation.

2) Palanne, Sahari: CO2 emissions from passenger cars and control of emissions through taxation, VATT Mimeo 63. The publication describes the material and calculations in detail.

Anna Sahari

Kimmo Palanne

Blog

Blogit

Environment, energy and climate policy

Income distribution and inequality

Taxation

behavioural responses

carbon pricing

carbon taxes

climate

climate change

climate policy

corrective taxation

cost-effectiveness

emission limits

emission trading

fossil fuels

fuel taxes

greenhouse emissions

impact assessment of policy measures

income distribution

tax policy

tax reforms

taxation

transport