Should the top income tax rate be lowered?

29.8.2017 Blog Kaisa Kotakorpi and Tuomas Matikka

The top income tax rate for earned income is not high enough in Finland that it would produce higher tax revenue if it was lowered, Kaisa Kotakorpi and Tuomas Matikka write in our blog.

Photo: Anssi Koskinen (cropped)

Photo: Anssi Koskinen (cropped)

After a few quieter years, taxation on people with high earnings has been under discussion during the Government's budget negotiations. This discussion has focused on debate over whether or not the extension of the decrease in income limits for the solidarity tax on people with high incomes (from EUR 90,000 to EUR 72,300), which was originally stipulated for two years, should be interpreted as tightened taxes.

Instead of this mainly semantic discussion, it would be more useful to consider what should actually be done to taxation on the highest level of income.

We discussed this question in our recent study. We assessed whether the top income tax rate for earned income applied to income exceeding the highest level in the state's income tax scale is high enough that, if it were lowered, we could receive higher tax revenue and, therefore, improve the wellbeing of all Finnish people. With regard to taxation on people with high income, Finland is among the leading countries, which means that this question is highly important in Finland. According to our estimates, the top income tax rate for earned income, however, is not high enough in Finland that it would produce higher tax revenue if it was lowered. In other words, lowering the top income tax rate would not finance itself. From this point of view, it is not necessary to lower the top income tax rate. We will discuss this in more detail below.

The idea behind the calculations starts from the assumption that a very high tax rate significantly reduces people's willingness to earn a higher income or report their additional income to the tax authority. In this case, it is possible to receive higher tax revenue by lowering the top income tax rate if people start to receive significantly higher earnings as a result of a lower income tax rate. However, income taxes start to decrease at some point if the tax rate is lowered even further because, when the tax rate decreases, its adverse impact on income starts to decrease, while the lower tax rate reduces tax revenue in itself.

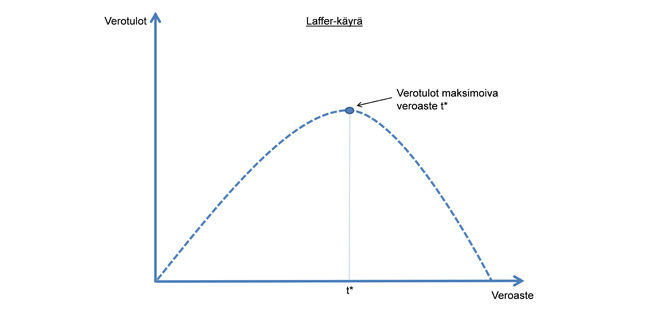

By utilising the so-called Laffer curve (see figure) discussed in economics literature, it is theoretically possible to define such a level of the top tax rate (t*) that maximises tax revenue. It is the point at which having a higher or lower tax rate would actually reduce tax revenue. This revenue-maximising tax rate is a key factor when evaluating tax policy. If we have exceeded the tax rate that maximises our tax revenue, it should be lowered, regardless of any political opinions on taxation and economic inequality. In this case, the wellbeing of everyone would improve: people with a high income within the scope of the highest tax rate bracket would earn more, and tax revenue would increase. Therefore, it would be possible to lower taxes or improve social security for other people, without reducing the total tax revenue or increasing the budget deficit.

The top tax rate that maximises tax revenue can also be studied empirically. It depends on the form of income distribution and how the tax brackets are set, as well as how sensitive people's earnings are to changes in tax rates, i.e. the elasticity of earnings with respect to income taxes.

The current top income tax rate for earned income in Finland does not exceed the revenue-maximising tax rate.

By utilising the observed income distribution and the elasticity estimates from empirical literature, we calculated that the current top tax rate for earned income in Finland does not exceed the revenue-maximising tax rate. Therefore, it is probable that we would lose tax revenue if the top income tax rate was lowered. In this case, the impact of the tax decrease on welfare would depend on how we value the wellbeing of people with different levels of income. In other words, lowering the top income tax rate does not automatically increase wellbeing for everyone.

According to our estimates, the revenue-maximising top earned income tax rate is 70–80%, depending on the assumptions used in calculations, which is higher than the current rate of 65% (taking commodity taxes into account). Thus we are probably on the left side of the point (t*) of the revenue-maximising tax rate on the Laffer curve, but we may not be very far from it. If you are interested in the detailed calculations, the most recent version of our research paper is available here. The study has been approved for publication in the Nordic Tax Journal.

In conclusion, we would like to point out how this calculation should not be interpreted. The revenue-maximising top earned income tax rate is not a reasonable goal or an optimal state to actively strive for. The public administration should maximise the wellbeing of citizens, which is probably different from maximising tax revenue. It cannot be said that increasing the top income tax rate to a revenue-maximising level would simply be the best possible policy.

The top tax rate that maximises tax revenue can also be studied empirically. It depends on the form of income distribution and how the tax brackets are set, as well as how sensitive people's earnings are to changes in tax rates, i.e. the elasticity of earnings with respect to income taxes.

Photo: Anssi Koskinen (cropped)

Kaisa Kotakorpi

Tuomas Matikka

Blog

Press release

Social security, taxation and inequality

elasticity of taxable income

income taxation

optimal taxation

public finances

tax policy

taxation

welfare