VAT cuts do not increase consumer purchasing power

An empirical study published in the Journal of Political Economy finds that VAT cuts are less likely to be passed on to consumer prices than VAT hikes. Following a temporary VAT cut, prices can even be higher than on onset.

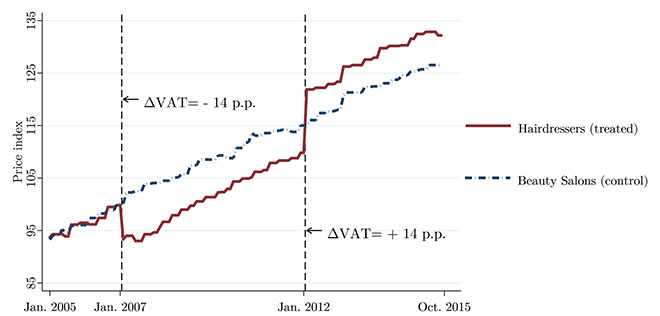

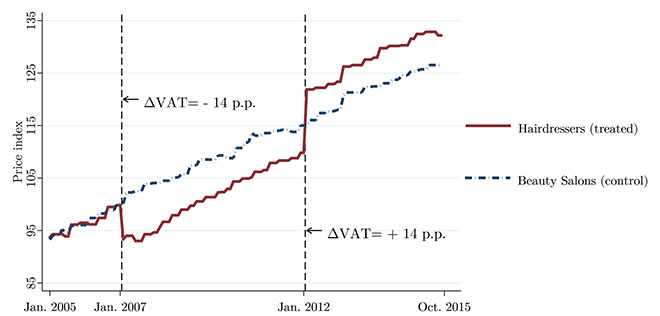

Figure 1. The VAT rate for hairdressing services was reduced by 14 percentage points in January 2007. In January 2012, the standard rate was reinstated increasing the VAT rate by 14 percentage. The figure compares the price indexes for hairdressing services and beauticians services, which were not affected by the VAT cut.

An empirical study published in the Journal of Political Economy finds that VAT cuts are less likely to be passed on to consumer prices than VAT hikes. Following a temporary VAT cut, prices can even be higher than on onset.

A number of countries are adopting temporary reductions to VAT rates as a means to support businesses hit by the corona lockdown. The expectation is that businesses will pass the reductions on to consumer prices and thereby boost consumer spending. However, according to the study, most businesses use VAT cuts to improve their finances instead of cutting prices.

A part of the study is formed by the analysis of VAT changes within the hairdressing industry in Finland. In 2007, the VAT rate for hairdressing services was reduced by 14 percentage points. After five years, in 2012, the standard rate was reintroduced increasing the VAT on hairdressing services by the same 14 percentage points.

According to the study, 60 % of prices did not respond to the VAT cut. However, they did respond to the reinstatement of the standard VAT rate: Almost all companies increased their prices by 80 to 120 % of the VAT rate increase.

- The VAT cut did slightly reduce prices, but returning to the standard rate increased prices by twice as much. Indeed, when the VAT reduction ended, the prices for hairdressing services were higher than they had been before the VAT cut, says research director Tuomas Kosonen from the Labour Institute of Economic Research.

The increase in the firms profits and markups following the VAT cut was twice as large as the reduction in profits and markups after the VAT hike.

- In particular, firms with low markups tend to respond asymmetrically to changes in VAT rates. They do not reduce their prices in response to VAT cuts, but they increase their prices considerably if the VAT rate is raised, states research professor Jarkko Harju from the VATT Institute for Economic Research.

EU-wide study: Prices react asymmetrically to VAT changes

The results do not only apply to hairdressing services in Finland. Harju and Kosonen teamed up with Youssef Benzarti (University of California Santa Barbara and NBER) and Dorian Carloni (Congressional Budget Office) to expand their research to encompass all VAT changes that took place in EU countries between 1996 and 2015.

They study VAT rate changes for over 2800 different commodities and find that prices tend to rise 3 to 4 times more after a VAT hike and they are reduced following VAT cut.

- Typically assessments of the the demand-side effects of VAT changes assume that the price effects of VAT cuts and hikes are symmetrical and that the tax changes are fully passed on to consumer prices. However, our empirical study clearly shows that such assessments overestimate the impact of VAT cuts on consumer spending, says Jarkko Harju.

- In Finland and other Nordic countries, good quality data from tax officials enables the precise study of the behavioural impacts of taxation. This study is in line with our other studies, which also find that the impact of consumption taxes on the consumption of goods and services is in effect rather modest, Tuomas Kosonen concludes.

Article:

Youssef Benzarti, Dorian Carloni, Jarkko Harju and Tuomas Kosonen (2020) What Goes Up May Not Come Down: Asymmetric Incidence of Value-Added Taxes. Journal of Political Economy (Preprint)

More information:

Research professor Jarkko Harju, VATT Institute for Economic Research, Tel. +358 295 519 410

Academy research fellow, Research director Tuomas Kosonen, Labour Institute for Economic Research, Tel. +358 40 940 2336

Jarkko Harju

Press release

Social security, taxation and inequality

Taxation

Uutiset ja tiedotteet

small firms

tax policy

tax reforms

taxation

value added tax